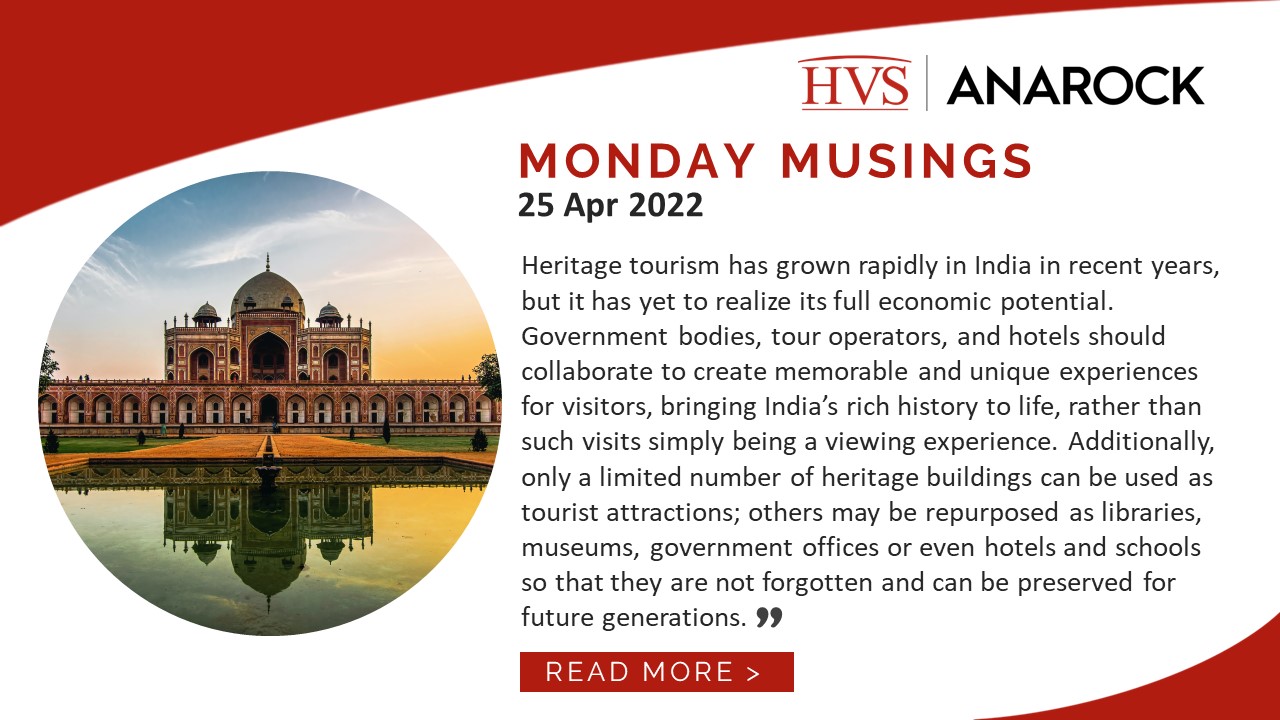

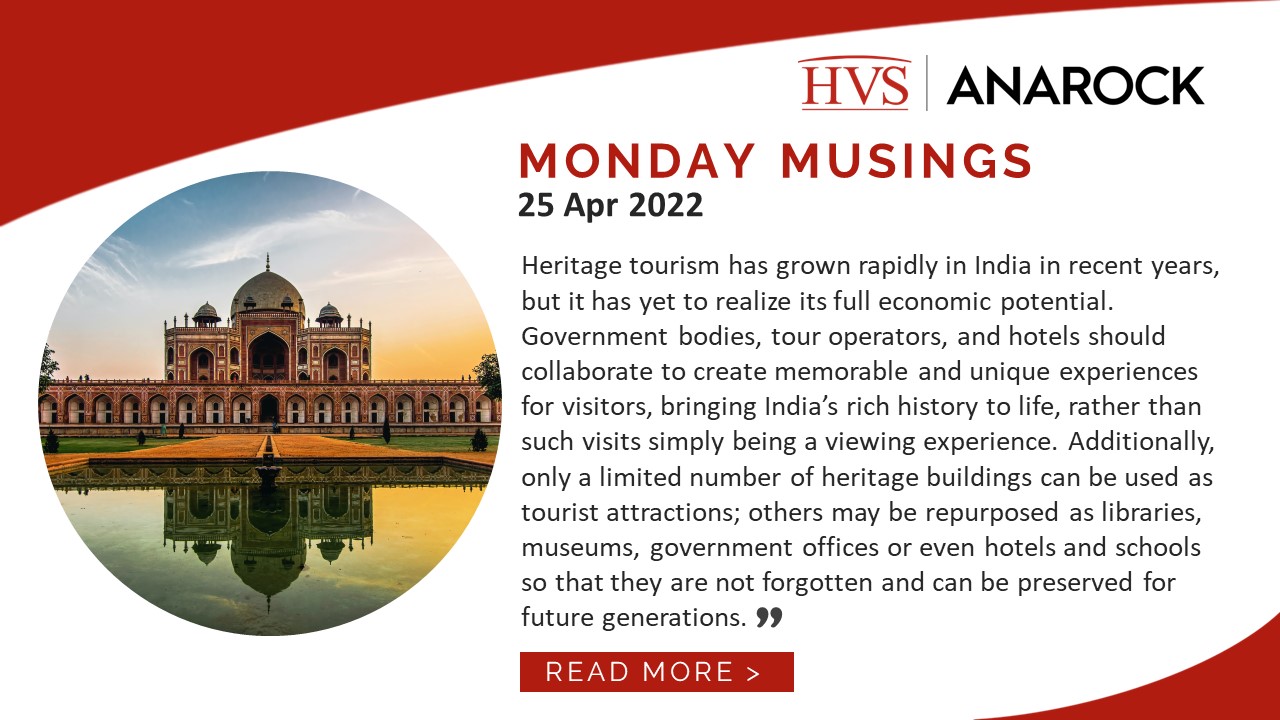

Heritage tourism has grown rapidly in India in recent years, but it has yet to realize its full economic potential. Read on to know more.

We have written thousands of articles about all aspects of hospitality, including valuations, investing, lending, operations, asset management, and much more.

Heritage tourism has grown rapidly in India in recent years, but it has yet to realize its full economic potential. Read on to know more.

The hospitality industry in Lonavala, a popular weekend destination near Pune and Mumbai, has thrived over the last 2 years. Read on to know more.

Reeling from the impact of new supply, seasonality, civil unrest, and a global pandemic, Minneapolis-St. Paul hotels faced a staggering RevPAR drop in 2020, worse than most cities in the United States. While the greater metro-area hotel market has begun to bounce back, it is at a much a slower pace than the national rebound. What has the recovery looked like thus far? When will the market return to pre-pandemic levels?

Remote work has opened several new avenues for hotels, including new customer segments and ancillary revenue streams. However, with most companies across industries now getting back to a hybrid or full work-from-office model, will these concepts continue to grow?

Over the last decade, the Dominican Republic has experienced robust growth in visitation, coupled with increased investment in the hospitality sector. This article explores the latest development trends in this important Caribbean destination.

The resumption of regular international flights in India is the first step towards a gradual return to normalcy for the travel and hospitality sectors. Read on to know more.

Post-pandemic travel trends indicate a strong demand for travel to Africa’s safari destinations, opening up opportunities for Investors and High-Net-Worth Individuals to invest in a fast-growing wildlife economy.

HVS publication In Focus Singapore 2022 provides an overview of Singapore’s economic outlook, infrastructure development, tourism landscape and hotel market performance, hotel transactions and investment in 2021, integrated resorts overview, COVID-19 situation and outlook.

This article discusses the key trends in hotel brand signings witnessed in the Indian hotel sector in 2021.

After facing a severe downturn in 2020 with a GDP contraction of around -2.1%, the Israeli economy rebounded strongly in 2021, recording growth of 7.1%. This article explores the hotel performance and development pipeline in Israel.

We have written thousands of articles about all aspects of hospitality, including valuations, investing, lending, operations, asset management, and much more.

Heritage tourism has grown rapidly in India in recent years, but it has yet to realize its full economic potential. Read on to know more.

The hospitality industry in Lonavala, a popular weekend destination near Pune and Mumbai, has thrived over the last 2 years. Read on to know more.

Reeling from the impact of new supply, seasonality, civil unrest, and a global pandemic, Minneapolis-St. Paul hotels faced a staggering RevPAR drop in 2020, worse than most cities in the United States. While the greater metro-area hotel market has begun to bounce back, it is at a much a slower pace than the national rebound. What has the recovery looked like thus far? When will the market return to pre-pandemic levels?

Remote work has opened several new avenues for hotels, including new customer segments and ancillary revenue streams. However, with most companies across industries now getting back to a hybrid or full work-from-office model, will these concepts continue to grow?

Over the last decade, the Dominican Republic has experienced robust growth in visitation, coupled with increased investment in the hospitality sector. This article explores the latest development trends in this important Caribbean destination.

The resumption of regular international flights in India is the first step towards a gradual return to normalcy for the travel and hospitality sectors. Read on to know more.

Post-pandemic travel trends indicate a strong demand for travel to Africa’s safari destinations, opening up opportunities for Investors and High-Net-Worth Individuals to invest in a fast-growing wildlife economy.

HVS publication In Focus Singapore 2022 provides an overview of Singapore’s economic outlook, infrastructure development, tourism landscape and hotel market performance, hotel transactions and investment in 2021, integrated resorts overview, COVID-19 situation and outlook.

This article discusses the key trends in hotel brand signings witnessed in the Indian hotel sector in 2021.

After facing a severe downturn in 2020 with a GDP contraction of around -2.1%, the Israeli economy rebounded strongly in 2021, recording growth of 7.1%. This article explores the hotel performance and development pipeline in Israel.

Robust demand in urban centers continues to drive Canadian hotel values despite high interest rate environment.