A new and dynamic era has begun for the serviced apartment industry. Our latest Serviced Apartment survey reveals a landscape marked by robust performance, adept cost management, and a positive outlook. Profitability has not only bounced back to pre-pandemic levels but is also being driven by a surge in leisure demand and a booming interest in serviced apartments. This renewed enthusiasm is drawing significant investor attention, prompting both established brands and new players to expand and innovate, setting the stage for exciting growth and transformation in the industry.

Operators' Sentiment

A page has been turned; a new chapter begins. Following challenging years of performance recovery, merciless inflationary growth and continued geopolitical turmoil, most agree that the European hotel industry has come out of the worst portion of the cycle. The feedback from our Serviced Apartment survey confirms robust performances, controlled cost management and an overall positive outlook going forward. Operators have witnessed a full rebound of profitability margins comparable to pre-pandemic levels, despite occupancy still lagging slightly. The recent growth in costs has been absorbed thanks to greater increases in average rates.

More recently, leisure demand has been a strong segment for serviced apartment operators, and some have noticed a continued increase in the first half of 2024. As this allows occupancy to grow, the flip side of the coin is that this type of segmentation tends to shorten the average length of stay in serviced apartments, bringing the model a little bit closer to that of traditional hotels.

The source of demand is also influenced by the growth in popularity of serviced apartments and the ensuing growth in supply observed post-pandemic. Seen as the star pupil during the downturn, the concept has caught the attention of investors, and properties have multiplied with more in the pipeline. Among the more well-known brands, we note that the Marriott serviced apartments portfolio (which includes Marriott Executive Apartments and Residence Inns) increased by 25% between 2019 and 2023. Beyond the push of existing brands, we have also witnessed the creation of new brands in larger operating platforms and a range of independent contenders, such as The July and The Other House. This supply growth, whilst meeting new trends in demand and travel fashions, also creates pressure and warrants flexibility to fill the new units. This also contributes to the length of stay decrease and to the potential loss of competitive edge of this distinct cost model.

A mitigating factor is the gradual return of corporate demand. The expectation is that the ramping of business travel will fill the occupancy gap and that by doing so the length of stay will return closer to pre-pandemic levels.

The concept of bleisure continues to be in the spotlight. Increasingly, guests are choosing to extend their stay to enjoy a destination after working hours or on the weekend and therefore seek the comfort that serviced apartments offer. Moreover, many companies have embraced remote working which, for many, has become an integral part of office life. Brands are emphasising co-living concepts, social spaces and clever designs, in order to target digital nomads. This thriving new generation of travellers chooses to explore the world while keeping their 9 to 5, and see an appealing solution in serviced apartments by having access to more space, a sense of community and amenities.

When it comes to expanding their brands, operators are looking at doing so on two fronts: geographically and with the development or creation of brands.

Operators who participated in our survey expressed an interest in developing in southern Europe, with Italy, Spain and Portugal the main targets. Western Europe also remains an appealing market, such as France, Germany, the Netherlands and the UK.

These expansion plans are being progressed via management agreements and leases mainly. Overall, operators are still relying on the same operating models that they have historically worked with, although some are also looking into developing more management agreements than they have in the past. While not commonly referred to, select brands are also increasing their franchise pipeline. For instance, Adagio particularly focuses on its franchise pipeline. Indeed, since 2018, Adagio has quadrupled its franchised network from five aparthotels then to 28 today, representing around 20% of its portfolio now. As a result, Adagio will target two-thirds of future openings to be carried out using the franchise model. By 2030, the brand aims to increase its proportion of franchised properties to 35%.

Brands and Concepts

|

Founded in 2018 in Finland, Bob W is a tech-driven, sustainability-centered operator. Currently present across 10 countries and 17 cities, Bob W is still developing an extensive network of properties. The brand’s pipeline includes properties in Stavanger, Cologne, Frankfurt, Leipzig, Hamburg, Stuttgart, Bergen, Paris, Rome, Brussels, Dublin, Vienna, Birmingham, Prague, Lisbon, Porto and Malaga. |

||

|

Hybrid hospitality leader Zoku, offering cleverly designed spaces targeted at business travellers, currently operates four properties in Amsterdam, Copenhagen, Paris and Vienna. Zoku is preparing its expansion to London. The decision to enter the London market underscores Zoku’s commitment to not only expanding its global footprint but also to innovating the way mixed-use properties serve the modern business traveller. |

||

|

With a 670-hotel portfolio, Hilton’s extended stay brand, Home2 Suites, benefits from strong recognition in the USA, Canada and China, but is yet to open in Europe. Home2 Suites offers a mid-tier concept with flexible spaces. All properties also offer a complimentary hot breakfast. A 290-unit property is set to open in Dublin city centre in 2025 marking the debut of the brand in Western Europe. |

||

|

Launched in 2021 in Australia as the tenth brand from TFE Hotels, A by Adina is now coming to Europe with the first property set to open in the first quarter of 2025 in Vienna. Offering unique designs, A by Adina positions itself as a luxury property within the Hotel Living category. A by Adina caters to corporate and lifestyle travellers. |

||

|

Dao by Dorsett will open a second property in Europe in Q4 2024, located in North London. This will be the third hotel of the brand globally, which is currently present in Singapore and West London. Dao West London, adjacent to the Dorsett hotel, opened in June 2022. The brand defines itself as a four-star hotel, providing a luxurious yet welcoming atmosphere and catering to both business and leisure travellers. |

||

|

Part of The Ascott Limited group, which includes multiple extended stay brands, lyf is a concept focussed on co-living, offering social spaces with a sense of community and targeting young travellers. lyf by Ascott is currently present in 11 countries with 26 properties, and its next expansion is set to open this year in Paris in the 20th arrondissement, near Père-Lachaise cemetery. |

||

|

Habyt was born in Berlin in 2017, created by a team of entrepreneurs looking to offer affordable and sustainable living solutions. After developing its co-living concept across 50 different cities, Habyt opened its first extended stay hotel in Europe, located in Berlin. Future expansion for the brand includes properties in Berlin, Frankfurt and Europacity. |

||

|

Cityden is one of the main players in the Netherlands with close to 400 apartments operating across four aparthotels in Greater Amsterdam. Cityden offers a great variety of room types ranging from studios to penthouses. Every location has its own restaurant and other hotel facilities such as a 24-hour reception, fitness centre and mini market. The next opening for Cityden is expected in Q4 this year, located in Amsterdam city centre. Cityden is interested in expanding into Rotterdam and other European markets. |

||

|

Marriott’s extended stay brand, Residence Inn, offers spacious suites designed with openness in mind. The units all include a fully equipped kitchen, a living space and a sleeping space. Residence Inn has doubled its portfolio of properties since 2019 and currently operates 31 properties across Europe. |

||

|

IHG’s brand Staybridge Suites currently has a portfolio of ten properties across Europe and 324 worldwide. Staybridge recently announced a number of projects to open in the coming years, including Malaga by the end of this year, Antwerp in 2026, and Budapest and Belfast in 2027. |

||

|

Adina Hotels Europe, owned and operated by Australian group TFE Hotels, recently opened the MM:NT Berlin Lab. Adina developed this innovative product as a standalone project, and defines this property as a test lab, always evolving through guest feedback. The property will welcome guests for free for the first two months, in exchange for feedback on the different individually designed rooms. The lab will operate a self-service model, with a concierge mobile app for check-in, check-out, and access to amenities. This new hybrid hospitality product will allow Adina to test out new features and constantly gather guest feedback to better develop future products. |

Performance Update

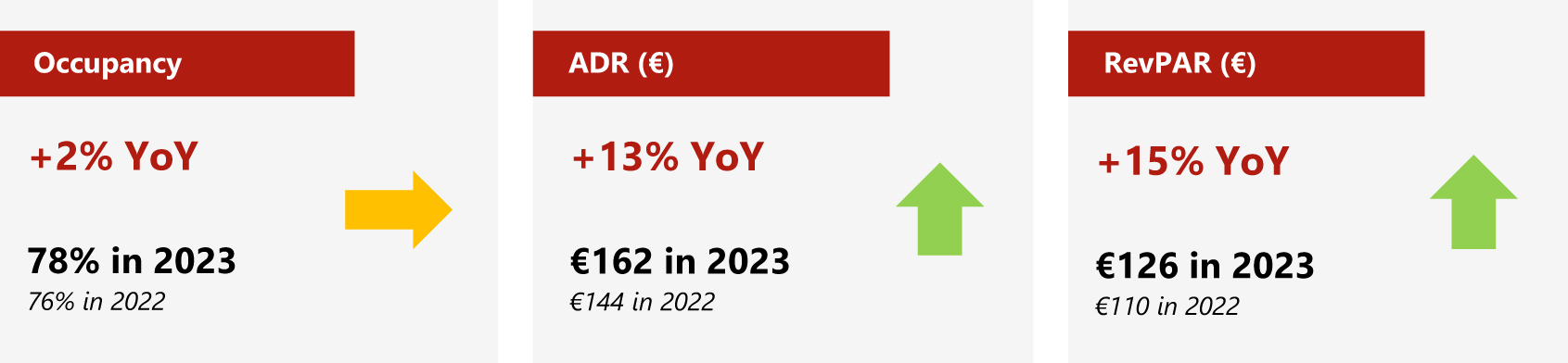

The following chart presents an overview of the recent average rate and RevPAR performance in Europe, as provided by the main Serviced Apartment operators in the market.

Chart 1: 2023 Serviced Apartment Performance Led by Average Rates

Source: HVS Research

Our performance analysis of around 9,000 serviced apartments across Europe reveals that occupancy increased by 2% between 2022 and 2023, along with a 13% increase in average rate. This resulted in a 15% growth in RevPAR. Over the same period, the hotel performance in Europe benefited from stronger occupancy growth, but a slightly lower average rate increase, which resulted in RevPAR growth marginally higher than that of the serviced apartments under review.

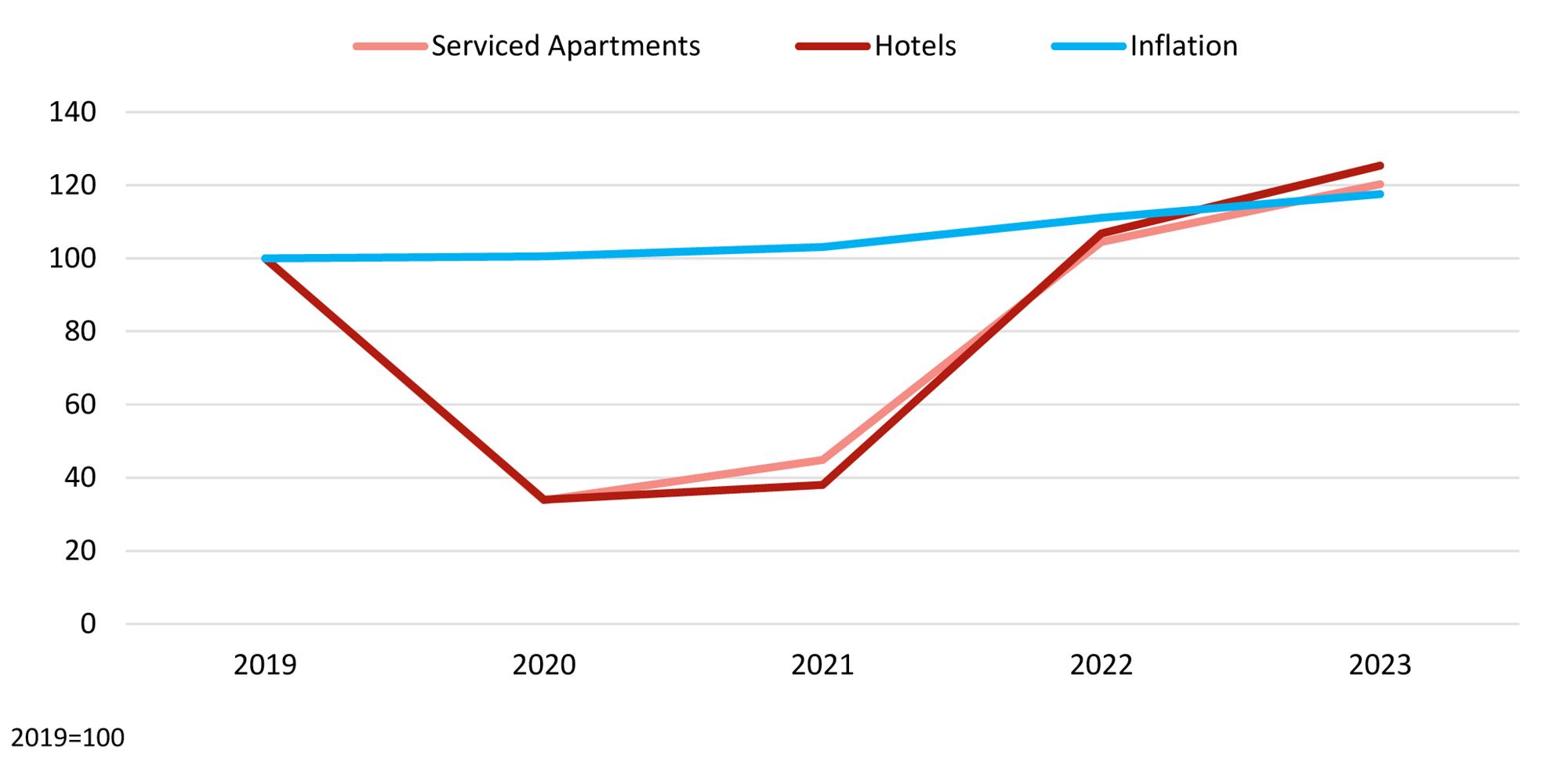

The responses to our operators’ survey, and confirmed in our analysis, indicate that in 2023 occupancy remained below pre-pandemic levels. However, as with the wider hospitality industry, serviced apartments benefited from impressive average rate growth over the last few years. From our analysis and compared to the inflation of countries our sample properties are located in, we estimate that, since 2019, the average rate and RevPAR of both hotels and serviced apartments have, on average, grown above inflation. In real terms, the average rate of serviced apartments caught up with inflation in 2022 and exceeded it in 2023, allowing RevPAR to also grow in real terms, despite occupancy not having fully stabilised yet. Our analysis shows that the 2023 rates for serviced apartments are more than 6.5% ahead of 2019, in real terms. However, we note that over the same period hotels show 11% growth in real terms, higher than serviced apartments.

Chart 2: RevPAR Grows Above Inflation in 2023 – Serviced Apartments vs Hotels – 2019 Indexed (€)

Source: HVS Research

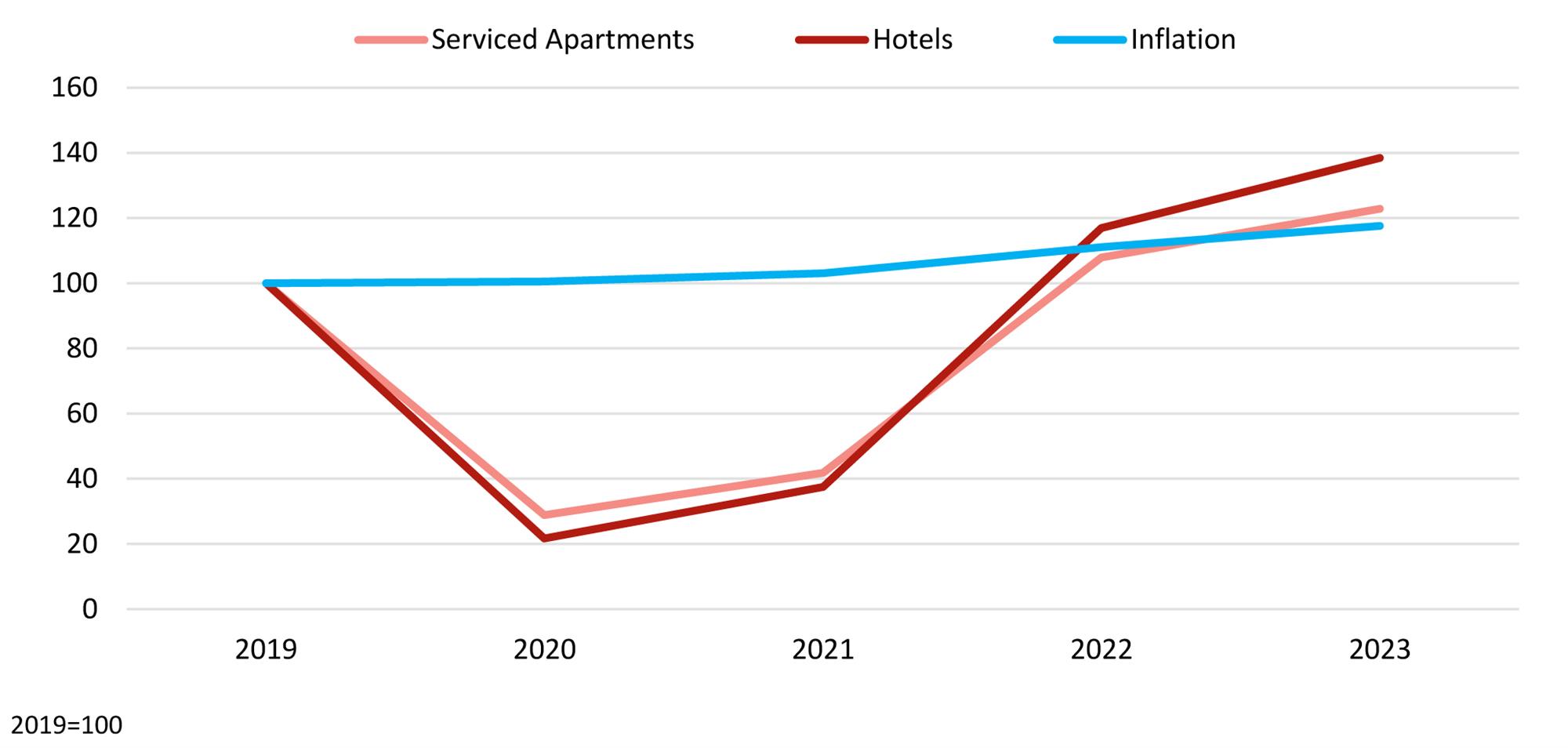

Focusing on the performances observed in capital cities, we notice a small disparity with the wider sample. Whilst the performances of serviced apartments in the European capitals follow the trends of the overall sample, the performances of hotels in a few capital cities have observed stronger growth in average rates than in the rest of the country. This was due to a combination of the influx of luxury properties and above-average rate growth in this hotel category, thus elevating the overall performances for hotels. This contributes to the distorted impression that hotels might be doing better than serviced apartments.

Chart 3: Influence of the Luxury Sector – Serviced Apartments vs Hotels in Capital Cities – 2019 Indexed (€)

Source: HVS Research

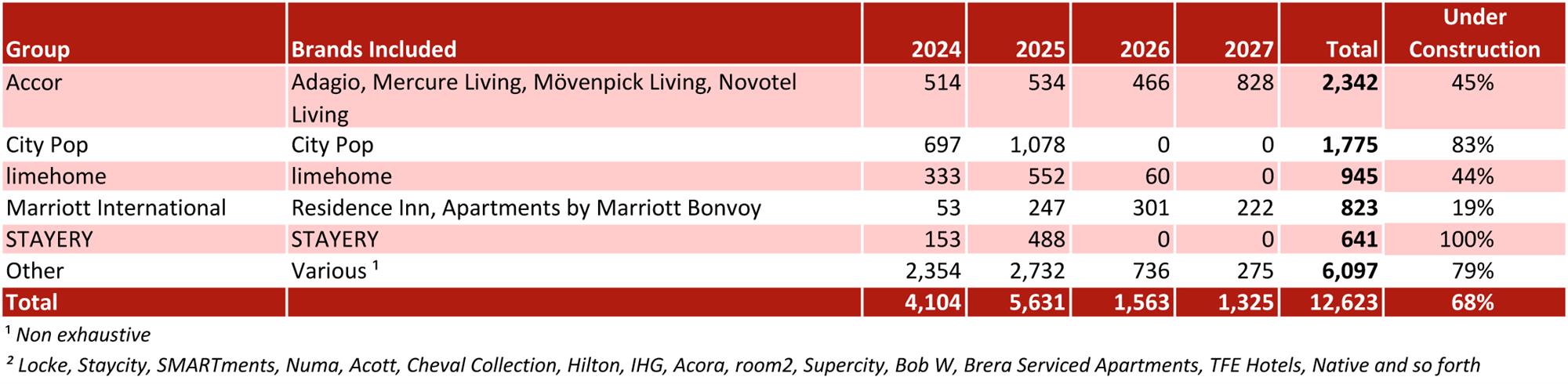

European Branded Pipeline

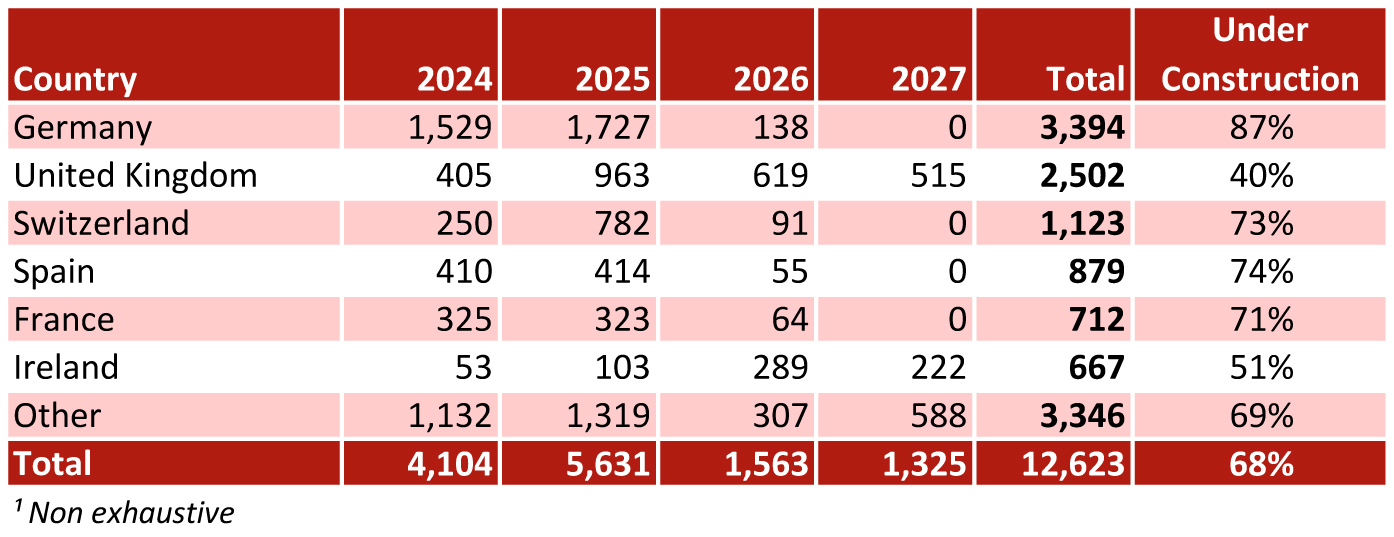

Generally, this report only considers branded developments that have been either confirmed by the operators or announced publicly as at the end of June 2024.

More than 12,600 rooms are expected to open within the next four years, reflecting the high level of activity in the serviced apartment sector within the industry.

Of these, 33% of the units (around 4,100) are due to open in the second half of 2024, followed by 45% set to open in 2025, 12% in 2026 and 10% in 2027. The sizes of planned projects vary from 7 to 370 units, with an average of 98 units.

Germany and the UK lead the way, with 27% and 17% of units in the total pipeline, respectively. Despite being the city with most branded serviced apartments, London continues to be the top development location with 27% of the country’s pipeline, followed by about 16% in Belfast, 12% in Glasgow and 10% in Cambridge. In Germany, Frankfurt is leading the way with about 19% of the country’s pipeline, followed by 12% in Stuttgart. Those two cities are ahead of the capital, Berlin, which is expected to welcome only around 9% of the country’s pipeline in the next few years.

Chart 4: New branded supply by country¹ (units)

Source: HVS Research

Our analysis indicates that Accor has the largest pipeline, with around 2,300 units to open in the next 3.5 years. Adagio, by itself, has just under 2,200 units (93% of the Accor pipeline), across 16 projects, in its pipeline, a third of which are located in the UK and the remaining ones in France, Germany, Italy, Ireland and Belgium. Excluding Adagio, about 52% of the Accor pipeline will open under the Mövenpick Living brand, 29% with Novotel Living, and another 19% with SLS Residences. City Pop closely follows with around 1,800 units to open during the second half of 2024 or in 2025. A majority of these properties will be located in Swiss cities including Zürich, Geneva, Lausanne and Basel, and the remaining ones in Germany (Berlin and Baden) and in Czech Republic (Prague). With the third-biggest pipeline in Europe, limehome has more than 900 units set to open in the next two-and-a-half years, mainly in Spain and Germany. Marriott comes next with 820 units expected to open before 2028; the group is largely developing its Residence Inn brand, with 95% of the pipeline within this brand, and the remaining 5% with the Apartments by Marriott Bonvoy brand. STAYERY will open 640 units before 2026, across 7 projects, all located in Germany.

Chart 5: New branded supply by brand¹ (units)

Source: HVS Research

A more detailed list of planned new supply can be found at the end of this report.

Investment and Lending Appetite in the Sector

In our survey, investors and lenders alike agreed that their appetite for the serviced apartment sector has increased in the past two years. This is thanks to the product’s higher profitability profile, continued trading strength and shielding from inflationary pressures.

One of the biggest challenges noted by investors is the restriction on capital allocated to new builds stemming from the increase in the cost of debt and construction costs. This challenge has led to an accrued interest in refurbishments and conversions, rather than developments. The goal is to re-invent existing spaces, keep as much of the standing structure as possible and shorten non-revenue-generating periods.

All actors in the serviced apartment sector agree that growth opportunities have been and will continue to be in conversion of real estate. After having long been considered an unwieldy and risky venture, when the existing use of the building generated sufficient return to see little upside from heavy investment, conversions are now attracting more interest. Nowadays, hotels, serviced apartments and co-living concepts as an investment have gained popularity, as offices have seen vacancy rates increase and, as a result, the price per square meter decrease. The trends behind those conversions are inspired by the existing architecture as well as the market demand, but also by a willingness to diversify the offering. This is why many serviced apartments are now adapting to having more co-working spaces, community-focused spaces, and why new concepts are being created to meet these new expectations. For example, VALO Hotel & Work was created to offer the facilities of a hotel, as well as offices and co-working spaces, but also meeting & events facilities. The July, formerly City ID, also developed meeting spaces at their property in Amsterdam, The July Boat & Co. Those stylish spaces will suit the needs of business meetings, but especially target social events: private dining, social drinks and parties, both indoor and outdoor – the variety of spaces in this property caters to all community-driven gatherings.

The challenges faced by the rise of the cost of debt and construction costs is also resulting in the creation of a new generation of brand models that still offer all the amenities expected in a serviced apartment but enclosed in a more compact space. As the price of real estate increases in most markets, and because serviced apartments are attracting more and more short- to medium-length leisure stays, brands have turned to smaller units that aim to improve the return on investment, especially for more centrally located assets.

All in all, the serviced apartment sector is seen by investors and lenders as being resilient with a strong appeal in even the worst times. This type of asset keeps gaining in popularity within the industry, with a significant amount of new supply being injected in numerous markets. The newest serviced apartment products also tend to get closer to traditional hotel products by targeting more leisure demand (which shortens the length of stay and impacts operational efficiencies), focusing more on prime locations and offering more facilities like restaurants. On the other side, hotel brands are also becoming more flexible and introducing some serviced apartment units within their inventory, especially if the demand is there or if the layout of a conversion is particularly inviting. The line between hotels and serviced apartments might be getting blurred and, down the line, these trends may result in a softening of the aspects that gave serviced apartments an edge over hotels, by increasing operational costs and therefore reducing the insulation from inflation and overall profitability. For now, the sector has the wind in its sails and the confidence of investors.

Transactions Activity

As with the wider hospitality industry, transaction activity for serviced apartments in 2023 remained subdued owing to the increase in the cost of debt and the persisting macroeconomic challenges. Our survey respondents noted that in 2024 the bid-ask spread for serviced apartment sales and acquisitions reduced somewhat, and with that gap seeming to narrow more deals are taking place.

Serviced apartment asset transactions in Europe since our last publication included a mix of portfolio- and single-asset transactions. Chart 6 presents details of the recent, single-asset, serviced apartment transactions that were available in the public domain.

Earlier this month, NUMA Group acquired the lifestyle brand Native Places, from Native Holdings. Native Places operates across the UK under two brands: Native ApartHotels, present in London, Manchester, Edinburgh and Glasgow, and The Apartment Collection, with ten locations in London. The portfolio comprises 800 units, which increased the overall NUMA portfolio to more than 7,300 units in Europe. This acquisition is part of NUMA’s strategy to expand across Europe, focusing on major cities and creating one of the largest platforms of lifestyle serviced apartments in Europe.

One recent portfolio transaction included the acquisition of ten centrally located properties in the Stavanger region of Norway, boasting nearly 400 serviced apartment units, in a transaction that also included the operating arm of Frogner House Hotels & Apartments. Vander Group acquired this portfolio from Merkantilbygg in April 2024 for an undisclosed sum.

In September 2023, CapitaLand Ascott Trust (CLAS), the largest hospitality fund in the APAC region, sold a portfolio of four aparthotels in regional France, totalling 333 rooms, for €44.4 million (€133,300 per room) to an undisclosed buyer. The portfolio included the 101-room Citadines City Centre Lille, the 97-room Citadines Castellane Marseille, the 77-room Citadines Prado Chanot Marseille and the 58-room Citadines Croisette Cannes. The exit yield on the deal was approximately 4.0%. The proceeds from the sale were earmarked for capital expenditure on remaining European assets and to fund the acquisition of three hotels in London.

Conclusion

The serviced apartment sector stands as a beacon of resilience and opportunity, even in the face of economic and logistical challenges. Its growing popularity and substantial new supply reflect a sector that is well suited to adapting to changing demands and market conditions. However, as serviced apartments and traditional hotels converge, the industry must navigate the potential impact on operational efficiencies and profitability. The sector’s current momentum, bolstered by investor confidence and a clear appetite for innovation, suggests a bright and dynamic future. With a favourable wind at its back, the serviced apartment industry is poised to continue its upward trajectory, redefining the landscape of hospitality and travel.

Addendum 1. Single Asset Transactions

Chart 6: Recent single asset transactions across Europe (€)

Source: HVS Research

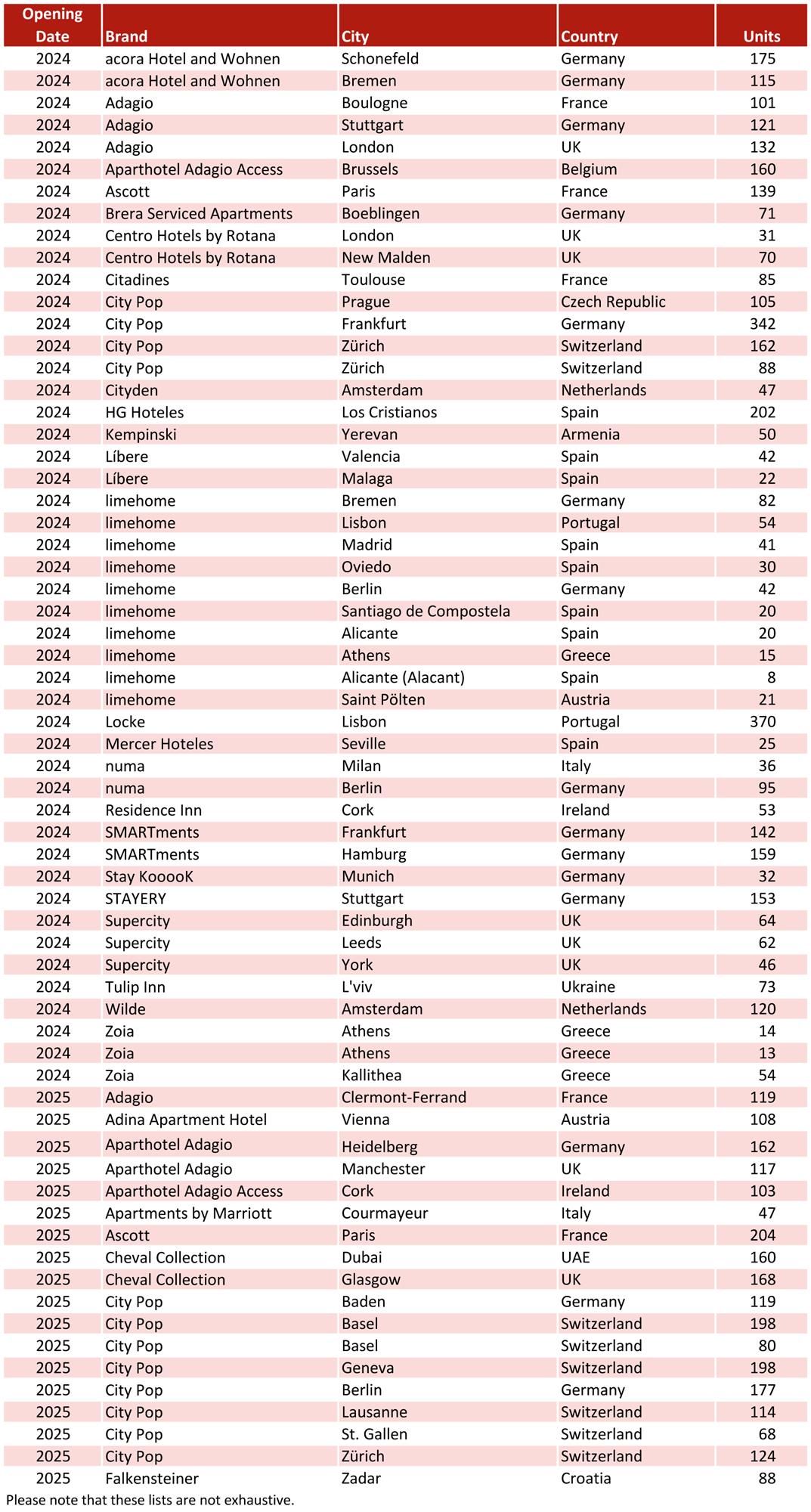

Addendum 2. European Branded Pipeline

Chart 7: Branded new supply pipeline across Europe – 2024-25 openings

Source: HVS Research

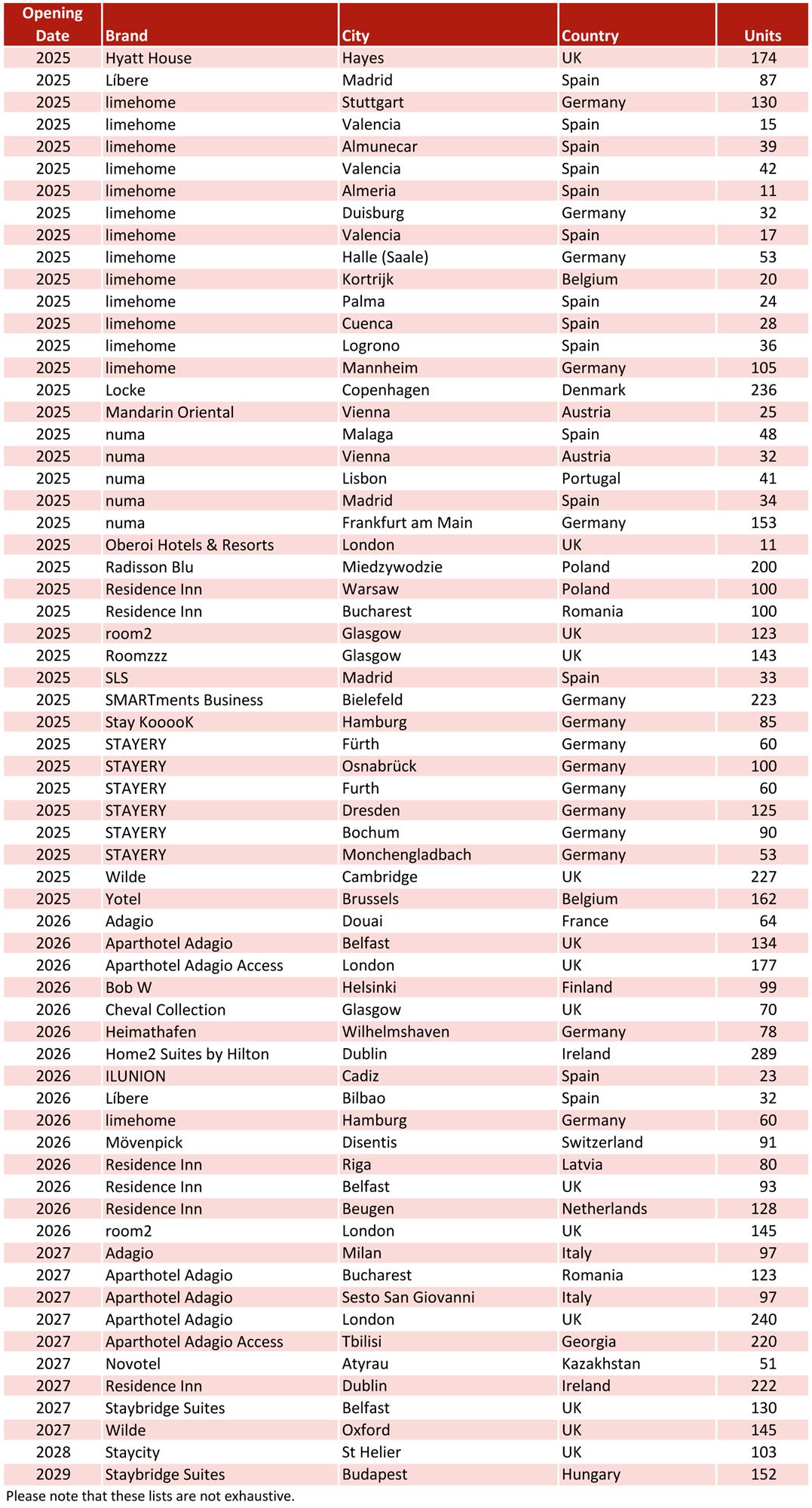

Chart 8: Branded new supply pipeline across Europe – 2025-27 openings

Source: HVS Research